Lafayette’s Financial Literacy Debacle

Ever-Fi page on student Clever with a module for sophomore students to begin.

Three hours in the rarely visited homeroom was probably different from how our student body expected to return to school after the bliss of a 2-week long winter break. To the surprise of most, Lafayette introduced its first financial literacy course to the student body with the help of Ever-Fi: K-12 Financial Education.

Lafayette’s financial literacy course comes straight from the top, the Kentucky State Capitol. In 2018, KRS 158.1411 was passed, enforcing a new financial literacy policy in all high schools across Kentucky. Starting the 2020-2021 school year, every high school student must have completed some financial literacy training that meets applicable requirements created by the Kentucky Department of Education.

Due to the COVID Pandemic, schools didn’t focus on developing a financial literacy program until schools could resolve more pressing issues facing their student body. The 2022-2023 school year brought many changes to our school life after COVID recovery, along with this program.

The bill does not specify the program or how schools must teach financial literacy courses. There is no funding for financial literacy programs, so districts and schools must finance course costs and teachers. Fayette County Public Schools decided on Ever-Fi, a free financial education program for K-12 students. It has a wide range of courses, with specific instructions and activities to help students learn topics related to finance education.

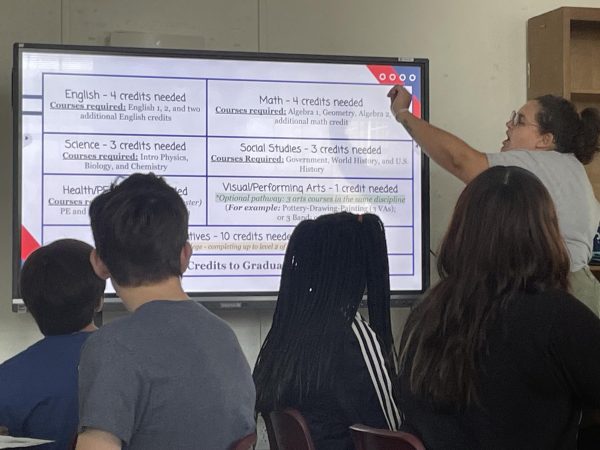

With Ever-Fi, every grade has a specialized course they need to go through. Each course outlines what is beneficial for each grade level and meets all the requirements they must have by the time they graduate. Freshmen learn Financial Literacy for High School, an introductory course to finance. Sophomores learn Investing Basics, investing in stocks and how to play it safe. Juniors learn about Modern Banking and Identity Protection, and how to be smart with online banking. Finally, Seniors learn how to finance their High Education, a critical skill for prospective college students.

On January 3rd, 2023, the first wave of Lafayette’s financial literacy courses began, but it didn’t go as expected. Initially, students were supposed to work the programs individually on their Chromebooks. School Wi-Fi has always been a struggle, which any student or staff member can attest to. Over winter break, Lafayette’s Wi-Fi was supposed to have been improved, making it easier to do the courses. However, problems with Lafayette’s internet provider prevented the upgrade, making it nearly impossible for 2,500 students to do one program without the whole Wi-Fi crumbling.

Teachers were responsible for leading homeroom through the program to combat the Wi-Fi issue. On short notice, teachers scrambled to prepare leading students through the course. With the last-minute changes, many students needed help understanding the intent of financial literacy.

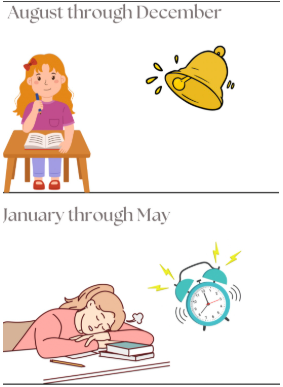

A teacher who wished to remain anonymous told the Times “At first, students were going to watch the videos independently and take the quiz independently, but then the Wi-fi wasn’t working, and that’s out of everybody’s control. I do think knowing about financial literacy, knowing about things like credit cards, the danger, and the benefits are really important. I do think it should be an actual class that goes into more depth and gives students maybe some real-world experience with that. Going over modules for 3 hours one morning the first day back from the semester, was not how students or teachers wanted to start the semester energy-wise.”

The Lafayette administration is not at fault for all these issues, as some things were out of their control. However, it would be helpful to keep student and staff opinion in mind to ensure that future programs impact students and are useful to them. One common observation of this reporter’s findings: the program was not engaging.

”The way they did it this time was hard for kids to pay attention to because it wasn’t super involved,” stated sophomore Vicky Lamarche.“They did [the Ever-Fi program] on the big screen because we weren’t allowed on our Chromebooks because we would’ve crashed the server. No one participated; there weren’t people giving answers.”

Sophomore Joey Hester said, “I think it was a good idea, but I don’t think it was executed properly, and I think it didn’t make an impact on these students’ lives because it was such a long period. Most teachers just presented the work to do instead of just doing it on [the students] own and let [students] interact with the program.”

“It was boring, and I have not recollected anything from it. We were supposed to learn, and I don’t think anyone did. None of the teachers were helping because they didn’t even know anything about it, so we were all just really confused together,” shared sophomore Dani Crosby.

Many students agree financial literacy is critical to learn in high school. It helps prepare you for the real world and teaches valuable skills to manage your money.

“I think it is important for students to understand their finances, especially since we are in high school and people are about to go into college where they are going to manage their own money and get student loans,” added Hester.

Crosby said, “I think it is important but I don’t think that it should be taught by teachers who don’t know what they’re talking about or don’t care. I feel like 99.99% of the school was not paying attention.”

Lafayette’s first run of financial literacy classes was an uphill battle. The administration still has many things to figure out, such as when to do courses and how to work around Wi-Fi issues. Financial literacy is one of the most valuable life skills, and it is crucial to start learning early. Financial literacy at Lafayette will evolve in the coming years with a practical implementation for all our students.